Equity Compensation Primer: ISOs v. NSOs

Many early-stage companies give employees, consultants, advisors, board members and other service providers (referred to as “service providers”) an opportunity to own a stake in the company through the grant of compensatory stock options (referred to as “options”). Options give service providers the chance to benefit directly from the company’s success while boosting service provider performance, loyalty, and long-term stability. Options require little to no cash outlay by the issuing company and offer service providers a high-ceiling opportunity to financially benefit from the company’s success. Some options even qualify for special preferential U.S. income tax treatment that can result in a lower tax bill for employee recipients.

This article explains why companies grant options to service providers and summarizes the key differences between the two types of options: incentive stock options (ISOs) and non-qualified stock options (NSOs). This article does not address tax considerations for non-U.S. taxpayers or securities laws, including federal and state registration exemptions that are commonly relied on when private companies grant service providers options.

Why grant employees and other service providers options?

Many companies grant service providers options to help align the interests of service providers with the company’s success. Options are often used to:

Options provide these benefits at little or no cash cost to the company.

What exactly is an option?

An option gives the recipient the right to purchase a specified number of shares of common stock at a fixed price per share (the “exercise price”) payable at the time the option is exercised. Because the exercise price is fixed when the option is granted, if the value of the shares is greater than the exercise price when the option is exercised, the service provider will be able to purchase shares of stock at a discount.

What is an incentive stock option or “ISO” and how are ISOs taxed?

An ISO is a special tax advantaged option that may only be granted to employees. If an option is designated as an “ISO” when granted and meets the requirements listed below, generally, the employee will not recognize taxable income attributable to the ISO until the shares purchased under the ISO are sold or otherwise disposed of. In addition, if certain holding periods are satisfied, the income on sale or other disposition of the shares will be characterized as long-term capital gains rather than ordinary income. Put simply, ISOs can provide a tax efficient mechanism for employees to participate in the economic success of the company. If the tax benefits are optimized, the employee can sell shares issued upon exercise of an ISO without ever paying ordinary income tax and instead only recognizing long-term capital gains on the sale of the shares. This can provide significant tax savings.

ISOs are taxed as follows:

What special requirements must be satisfied to make an option an ISO?

The following requirements must be satisfied for an option to qualify as an ISO:

A validly issued option that is granted as an ISO but fails to satisfy the ISO requirements at or after the time of grant will automatically be treated as an NSO. For example, because only employees are eligible to receive ISOs, any ISO granted to an independent contractor is automatically treated as an NSO.

What is a non-statutory stock option or “NSO” and how are NSOs taxed?

An NSO is an option that does not satisfy the ISO requirements—either intentionally or unintentionally. NSOs may be granted to employees as well as contractors, advisors, board members and other service providers, including entity service providers.

NSOs are taxed as follows:

What’s an 83(b) Election?

Some options may be exercised before the option vests—referred to as “early exercise”. If a service provider early exercises an NSO and receives unvested shares, the service provider may elect under Section 83(b) of the Internal Revenue Code to include as ordinary income in the year of exercise an amount equal to the excess of the fair market value of those unvested shares on the exercise date over the exercise price paid for the shares (a Section 83(b) election). If the service provider makes a Section 83(b) election, the service provider will not recognize any additional ordinary income when the shares vest. The deadline for filing a Section 83(b) election with the Internal Revenue Service is thirty (30) days following the date the option is exercised. The ordinary income resulting from a Section 83(b) election is subject to applicable tax withholding requirements.

Wait, so what’s the difference between ISOs and NSOs?

At a very high level, income on ISOs is generally not subject to tax (with the caveat of the AMT tax) until the employee sells or otherwise disposes of the shares issued on exercise of the ISO. Income on NSOs is generally subject to federal income taxation upon exercise of the option—in an amount equal to the difference between the exercise price and the fair market value of the shares on the date of exercise—and capital gains taxation upon sale of the shares—in an amount equal to the difference between the fair market value of shares on the date of exercise and the sale price.

What type of stock option benefits employees most?

It depends!

Assuming that the fair market value of the shares underlying the option increase after the option is granted, and the service provider can afford to and does exercise the option at the time of grant, the service provider may receive the most benefit from the grant of an early exercise NSO because the taxable amount will be similar to that of an ISO but without the longer holding period requirements. On the other hand, if the service provider is an employee and the option is not subject to early exercise, the employee will likely benefit the most from the grant of an ISO.

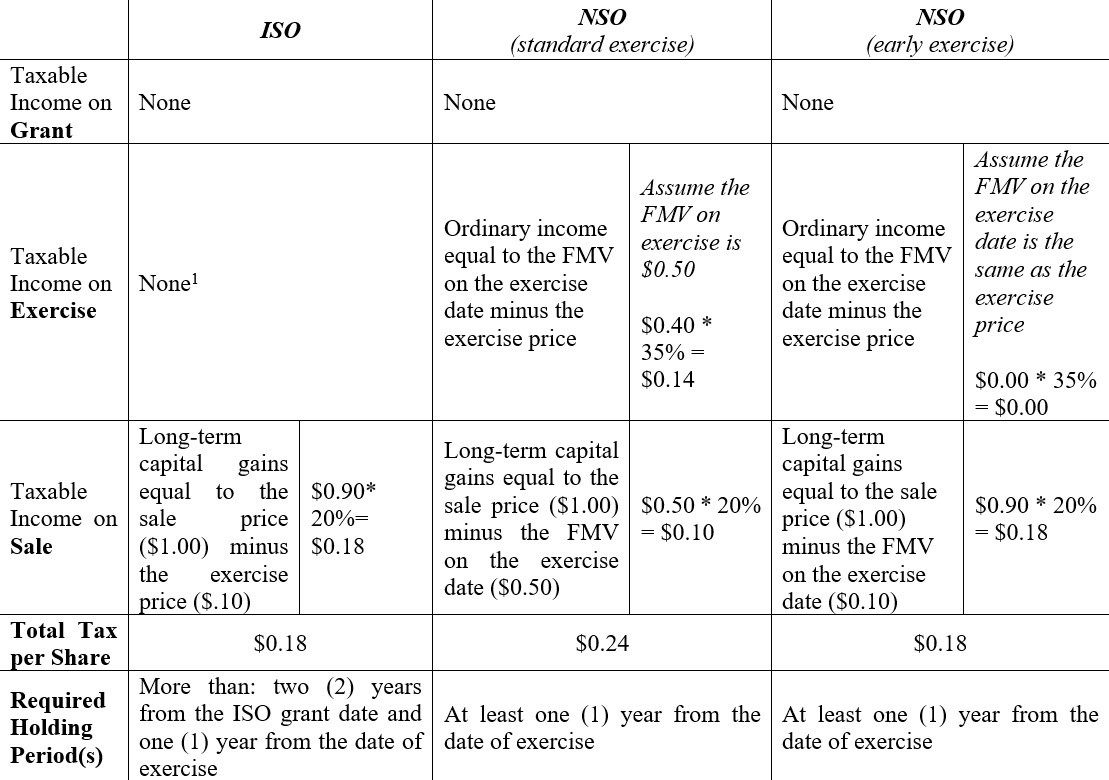

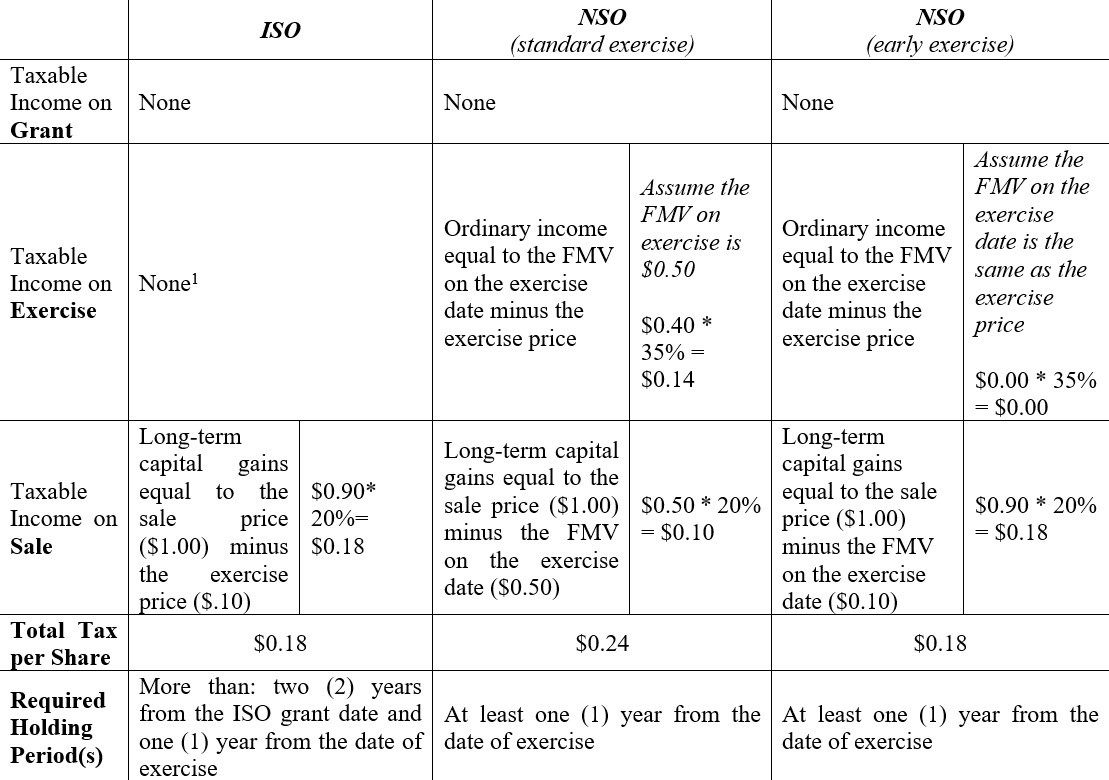

To illustrate the how the tax treatment of ISOs and NSOs (with and without early exercise) differs, consider a scenario where an early stage startup grants an employee a stock option with an exercise price of $0.10 per share, the employee exercises the option and then sells the shares two (2) years later for $1.00 per share. Assuming all other requirements are satisfied, an ordinary income tax rate of 35% and a long-term capital gains tax rate of 20%, the applicable taxes would be:

In this scenario, the cumulative tax bill for an ISO is 25% lower than the tax bill for an NSO that is not subject to early exercise. However, similar tax benefits are available by early exercising an NSO at the time when the fair market value per share does not exceed the exercise price.

Determining which type of option is “best” for any service provider requires understanding the tax treatment, including the holding period requirements, as well as forecasting the financial success of the company and potential liquidity events. Many of these facts will be unknown at the time that options are granted. As a result, most early-stage companies grant employees ISOs since ISOs allow employees to “wait and see” before exercising the option while still offering favorable tax treatment.

Note on Tax Advice: This article has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

This article explains why companies grant options to service providers and summarizes the key differences between the two types of options: incentive stock options (ISOs) and non-qualified stock options (NSOs). This article does not address tax considerations for non-U.S. taxpayers or securities laws, including federal and state registration exemptions that are commonly relied on when private companies grant service providers options.

Why grant employees and other service providers options?

Many companies grant service providers options to help align the interests of service providers with the company’s success. Options are often used to:

- Align the interests of the company’s service providers with those of the company’s stockholders.

- Supplement salary and benefits, making positions more attractive to potential hires while conserving company cash.

- Encourage service providers to develop an ownership mentality and commitment to the future of the company by offering a stake in the company’s financial upside (or downside once options are exercised).

- Promote retention through the use of vesting—i.e., options typically vest over several years, encouraging service providers to stay with the company longer to realize the full benefits.

Options provide these benefits at little or no cash cost to the company.

What exactly is an option?

An option gives the recipient the right to purchase a specified number of shares of common stock at a fixed price per share (the “exercise price”) payable at the time the option is exercised. Because the exercise price is fixed when the option is granted, if the value of the shares is greater than the exercise price when the option is exercised, the service provider will be able to purchase shares of stock at a discount.

What is an incentive stock option or “ISO” and how are ISOs taxed?

An ISO is a special tax advantaged option that may only be granted to employees. If an option is designated as an “ISO” when granted and meets the requirements listed below, generally, the employee will not recognize taxable income attributable to the ISO until the shares purchased under the ISO are sold or otherwise disposed of. In addition, if certain holding periods are satisfied, the income on sale or other disposition of the shares will be characterized as long-term capital gains rather than ordinary income. Put simply, ISOs can provide a tax efficient mechanism for employees to participate in the economic success of the company. If the tax benefits are optimized, the employee can sell shares issued upon exercise of an ISO without ever paying ordinary income tax and instead only recognizing long-term capital gains on the sale of the shares. This can provide significant tax savings.

ISOs are taxed as follows:

- Grant of the Option: No income tax on grant.

- Vesting of the Option: No income tax on vesting.

- Exercise of the Option: No income tax on vesting.[1]

- Sale of Shares: The U.S. federal income tax income tax liability on the sale or other disposition of shares issued upon exercise of an ISO depends upon whether the sale or other disposition is a qualifying or disqualifying disposition. A qualifying disposition will occur if the sale or other disposition of the shares takes place more than two (2) years after the date the ISO for the shares was granted and more than one (1) year after the date that option was exercised for the particular shares involved in the disposition. A disqualifying disposition will occur unless both of these requirements are satisfied.

- Upon a qualifying disposition, the employee will recognize long-term capital gain equal to the excess of the amount realized upon the sale or other disposition of the shares over the exercise price paid for the shares. The employee will recognize a long-term capital loss if the amount realized is lower than the exercise price paid for the shares.

- Upon a disqualifying disposition, the employee will recognize ordinary income at the time of the disposition in an amount equal to the excess of the fair market value of the shares on the option exercise date minus the exercise price paid for those shares. Income recognized from the disqualifying disposition will be reported by the company as taxable compensation income on the employee’s W-2 wage statement for the year of disposition, but will not be subject to withholding of income tax or Social Security/Medicare taxes. Any additional gain recognized upon the disqualifying disposition will be capital gain, which will be long-term capital gain if the shares have been held for more than one (1) year following the exercise date of the option.

What special requirements must be satisfied to make an option an ISO?

The following requirements must be satisfied for an option to qualify as an ISO:

- Status of the Issuer: The issuer must be a corporation/taxed as a corporation.

- Approved Plan: ISOs must be granted pursuant to a written plan that is adopted by the issuer’s board and approved by the stockholders of the issuer withing 12 months before or after the date that the plan is adopted.

- The plan must designate the maximum aggregate number of shares that may be issued pursuant to the exercise of ISOs.

- ISOs must be granted within ten (10) years of the adoption of the plan or the date that the plan is approved by the issuer’s stockholders, whichever is earlier.

- Designated as an ISO: The option must be designated as an ISO at the time of grant (often as part of the board action granting the option).

- Employees Only: ISOs can only be granted to employees of the issuing company (or its affiliates). Contractors or other service providers, including advisors and non-employee directors, are not eligible to receive ISOs.

- Term: An ISO may have a maximum term of ten (10) years from the date of grant (or five (5) years for any individual who owns or is treated as owning stock possessing more than 10% of the total combined voting power of all classes of stock of the issuer as of immediately prior to the time the option is granted, referred to as a 10% stockholder).

- Exercise Price: ISOs must be granted with a per share exercise price that is not less than the per share fair market value on the date of grant. The per share exercise price of an ISO granted to a 10% stockholder must be not less than 110% of the per share fair market value on the date of grant. For a discussion of how to determine the FMV, please see our article Equity Compensation: Navigating 409A Valuations.

- $100K Annual Limit: The fair market value of ISOs that are exercisable for the first time in any calendar year may not exceed $100,000 per employee based on the fair market value at the time of grant (any excess will automatically be treated as an NSO).

- Post-Termination Exercise Period: An ISO that remains outstanding for more than three (3) months (unless due to death or disability) following the employee’s termination from service as an employee, will automatically convert to an NSO.

- Transferability: ISOs are not transferable during the life of the employee.

A validly issued option that is granted as an ISO but fails to satisfy the ISO requirements at or after the time of grant will automatically be treated as an NSO. For example, because only employees are eligible to receive ISOs, any ISO granted to an independent contractor is automatically treated as an NSO.

What is a non-statutory stock option or “NSO” and how are NSOs taxed?

An NSO is an option that does not satisfy the ISO requirements—either intentionally or unintentionally. NSOs may be granted to employees as well as contractors, advisors, board members and other service providers, including entity service providers.

NSOs are taxed as follows:

- Grant of the Option: No income tax on grant.

- Vesting of the Option: No income tax on vesting (provided that the NSO was granted with a per share exercise price that was not less than the per share fair market value on the date the option was granted).

- Exercise of the Option: On exercise, the service provider will recognize ordinary income in an amount equal to the excess of the fair market value of the purchased shares on the exercise date minus the exercise price paid for the shares. If the service provider is an employee, the company is required to withhold and remit income tax or Social Security/Medicare taxes with respect to such income. This income will be reported by the company on W-2 wage statement for the year of exercise (or on a form 1099 if the service provider is not an employee).

- Sale of Shares: Upon the sale of the shares, the service provider will recognize a capital gain to the extent the amount realized upon the sale exceeds their fair market value at the time of acquisition. A capital loss will result to the extent the amount realized upon the sale is less than the fair market value at the time the service provider recognized the ordinary income. The gain or loss will be long-term if the shares are held for more than one (1) year prior to the sale. The holding period will start at the time the NSO is exercised for vested shares (or, if the NSO is exercised before it is vested and an 83(b) election is timely filed, at the time the option is exercised).

What’s an 83(b) Election?

Some options may be exercised before the option vests—referred to as “early exercise”. If a service provider early exercises an NSO and receives unvested shares, the service provider may elect under Section 83(b) of the Internal Revenue Code to include as ordinary income in the year of exercise an amount equal to the excess of the fair market value of those unvested shares on the exercise date over the exercise price paid for the shares (a Section 83(b) election). If the service provider makes a Section 83(b) election, the service provider will not recognize any additional ordinary income when the shares vest. The deadline for filing a Section 83(b) election with the Internal Revenue Service is thirty (30) days following the date the option is exercised. The ordinary income resulting from a Section 83(b) election is subject to applicable tax withholding requirements.

Wait, so what’s the difference between ISOs and NSOs?

At a very high level, income on ISOs is generally not subject to tax (with the caveat of the AMT tax) until the employee sells or otherwise disposes of the shares issued on exercise of the ISO. Income on NSOs is generally subject to federal income taxation upon exercise of the option—in an amount equal to the difference between the exercise price and the fair market value of the shares on the date of exercise—and capital gains taxation upon sale of the shares—in an amount equal to the difference between the fair market value of shares on the date of exercise and the sale price.

What type of stock option benefits employees most?

It depends!

Assuming that the fair market value of the shares underlying the option increase after the option is granted, and the service provider can afford to and does exercise the option at the time of grant, the service provider may receive the most benefit from the grant of an early exercise NSO because the taxable amount will be similar to that of an ISO but without the longer holding period requirements. On the other hand, if the service provider is an employee and the option is not subject to early exercise, the employee will likely benefit the most from the grant of an ISO.

To illustrate the how the tax treatment of ISOs and NSOs (with and without early exercise) differs, consider a scenario where an early stage startup grants an employee a stock option with an exercise price of $0.10 per share, the employee exercises the option and then sells the shares two (2) years later for $1.00 per share. Assuming all other requirements are satisfied, an ordinary income tax rate of 35% and a long-term capital gains tax rate of 20%, the applicable taxes would be:

In this scenario, the cumulative tax bill for an ISO is 25% lower than the tax bill for an NSO that is not subject to early exercise. However, similar tax benefits are available by early exercising an NSO at the time when the fair market value per share does not exceed the exercise price.

Determining which type of option is “best” for any service provider requires understanding the tax treatment, including the holding period requirements, as well as forecasting the financial success of the company and potential liquidity events. Many of these facts will be unknown at the time that options are granted. As a result, most early-stage companies grant employees ISOs since ISOs allow employees to “wait and see” before exercising the option while still offering favorable tax treatment.

Note on Tax Advice: This article has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

[1] Disclaimer: The foregoing discussion does not address the alternative minimum tax (AMT). Under AMT calculations, the spread between the exercise price and fair market value of stock underlying ISOs at the time of exercise is a “preference item” that is added back to a taxpayer’s alternative minimum taxable income for purposes of calculating AMT, which may result in increased tax liability for an annual taxpayer. For additional information about AMT, please refer to https://www.irs.gov/taxtopics/tc556 and consult with your individual tax advisor.