Qualified Small Business Stock: Tax Benefits for Startup Investors are Bigger and More Beautiful

In a move to bolster investment in small business, the “One Big Beautiful Bill Act” (OBBBA), signed into law on July 4, 2025 (the “Applicable Date”), introduced significant changes to the Qualified Small Business Stock (QSBS) provisions under Section 1202 of the Internal Revenue Code. These amendments increase the benefits related to QSBS to spur further investment into small business by investors and founders.

Key Changes to the QSBS rules Under OBBBA

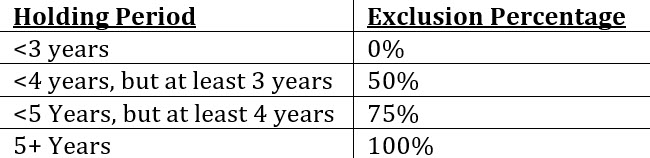

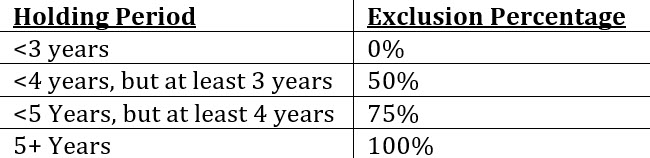

Tiered Gain Exclusion Based on Holding Period

Previously, investors were required to hold QSBS for at least five (5) years to qualify for a 100% capital gains exclusion (up to a cap). The OBBBA introduces a phased approach for stock issued after the Applicable Date, allowing investors to benefit from the QSBS benefits earlier:

Increased Asset Threshold for Issuing Corporations

Under prior law, the maximum aggregate gross assets a corporation could have to qualify as a small business (and issue QSBS-eligible stock) was $50 million. For stock issued after the Applicable Date, the OBBBA increased the relevant amount to $75 million, adjusted for inflation starting in 2027. This change enables larger startups to issue QSBS-eligible stock.

Higher Per-Issuer Exclusion Cap

Previously, the maximum amount of gain a taxpayer could exclude from income, with respect to stock of a single issuer, was the greater of $10 million or 10 times the taxpayer’s basis in its stock. While the 10x basis test has not changed, under the OBBBA, for stock issued after the Applicable Date, the per-issuer gain exclusion limit has increased to $15 million, adjusted for inflation beginning in 2027. A corresponding change has also been made to the exclusion limitations for married individuals filing separately. This change to the exclusion cap allows investors to exclude more gain from taxation when selling QSBS, providing further incentives to invest in small businesses.

In summary, the OBBBA’s enhancements to the QSBS regime represent a meaningful shift in tax policy designed to stimulate greater investment in the startup and small business ecosystem. By introducing a more flexible tiered exclusion structure, raising the qualifying asset threshold for issuers, and increasing the per-issuer gain exclusion cap, the legislation significantly boosts the appeal of QSBS for both investors and founders. As always, investors and founders should consult with tax advisors to navigate the new rules and optimize their strategies in light of these expanded opportunities.

Key Changes to the QSBS rules Under OBBBA

Tiered Gain Exclusion Based on Holding Period

Previously, investors were required to hold QSBS for at least five (5) years to qualify for a 100% capital gains exclusion (up to a cap). The OBBBA introduces a phased approach for stock issued after the Applicable Date, allowing investors to benefit from the QSBS benefits earlier:

Increased Asset Threshold for Issuing Corporations

Under prior law, the maximum aggregate gross assets a corporation could have to qualify as a small business (and issue QSBS-eligible stock) was $50 million. For stock issued after the Applicable Date, the OBBBA increased the relevant amount to $75 million, adjusted for inflation starting in 2027. This change enables larger startups to issue QSBS-eligible stock.

Higher Per-Issuer Exclusion Cap

Previously, the maximum amount of gain a taxpayer could exclude from income, with respect to stock of a single issuer, was the greater of $10 million or 10 times the taxpayer’s basis in its stock. While the 10x basis test has not changed, under the OBBBA, for stock issued after the Applicable Date, the per-issuer gain exclusion limit has increased to $15 million, adjusted for inflation beginning in 2027. A corresponding change has also been made to the exclusion limitations for married individuals filing separately. This change to the exclusion cap allows investors to exclude more gain from taxation when selling QSBS, providing further incentives to invest in small businesses.

In summary, the OBBBA’s enhancements to the QSBS regime represent a meaningful shift in tax policy designed to stimulate greater investment in the startup and small business ecosystem. By introducing a more flexible tiered exclusion structure, raising the qualifying asset threshold for issuers, and increasing the per-issuer gain exclusion cap, the legislation significantly boosts the appeal of QSBS for both investors and founders. As always, investors and founders should consult with tax advisors to navigate the new rules and optimize their strategies in light of these expanded opportunities.